AMC’s meme stock antics let ‘home run’ arbitrage through

Posterchild for memes, the cash-raising plan of AMC Entertainment Holdings Inc. has put it in the sights of arbitrage traders who perceive a great chance to profit from a reorganization of its share structure.

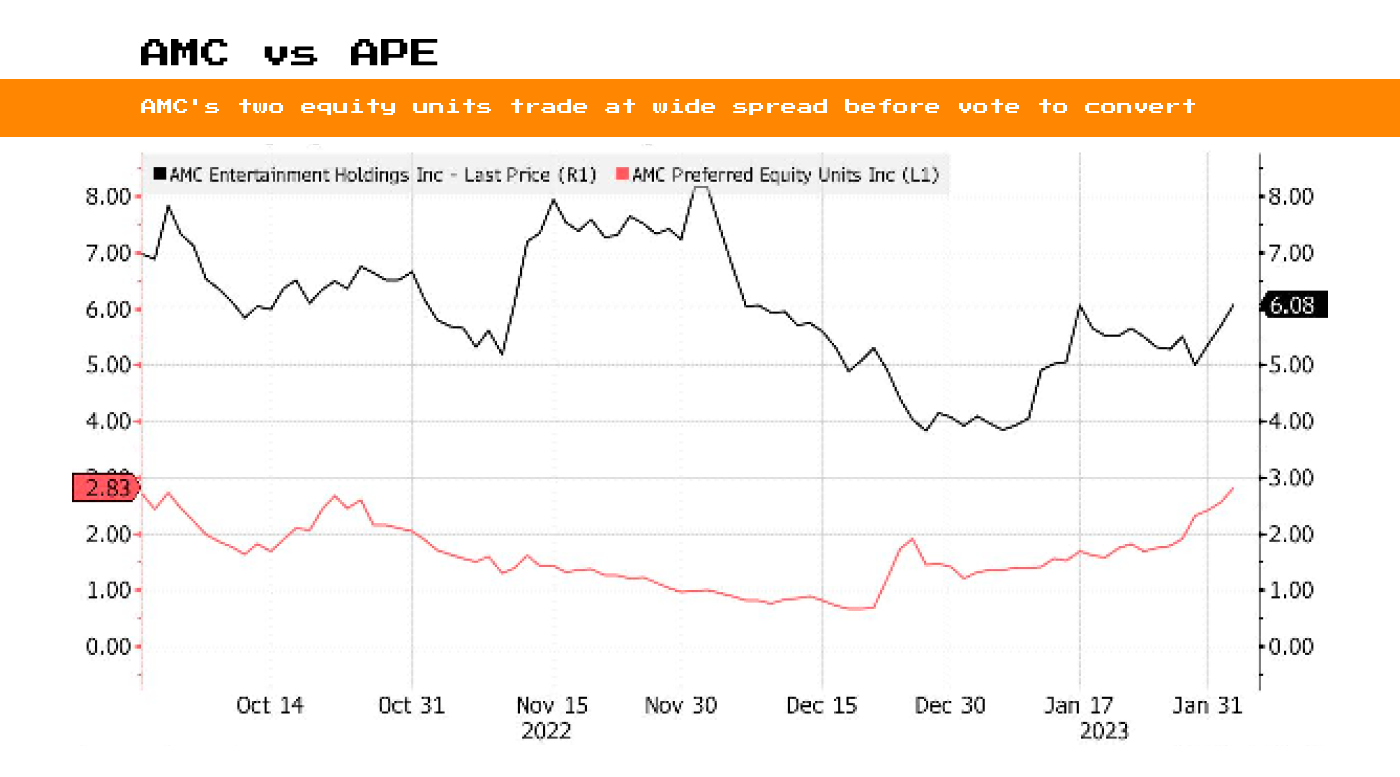

Next month, investors are anticipated to approve the movie theater operator’s conversion of preferred shares (ticker: APE) into AMC common stock. During the pandemic, this operator became a favorite of retail traders. The one-for-one trade is a component of a larger plan to raise money and maintain the lights.

Now that there is a noticeable difference between the two assets, arbitrage traders may profit from it.

On Thursday, AMC shares finished at $6.08, and APE units closed at $2.83. There is a $3.25 price difference, which is unprecedented on Wall Street. It finally reached a rise of 5%.

“This is by far the most appealing arbitrage opportunity available”, said Julian Klymochko, chief executive officer of Accelerate Financial Technologies. “You don’t see a hundred percent plus gross return in six weeks on a high probability deal very often”.

Investors like Klymochko have been using a classic risk arbitrage strategy to capture the spread: acquire APE units while attempting to reduce the downside risk if the vote fails and short AMC shares. But there is some danger involved in such a plan.

One major obstacle to even participating in the trade is the rising cost of borrowing AMC shares to sell them short. According to statistics from S3 Partners, over 22% of the AMC shares that are now on the market are being sold short, and the costs associated with shorting the stock have more than tripled this year.

If you can secure a steady loan, it’s a home run. But that’s the issue, according to Cabot Henderson, a JonesTrading specialist in merger arbitrage and unique circumstances.

Further complicating matters for the risk arbitrage community, which traditionally favors simple wagers, is the volatile nature of meme stocks, which are assets that trade at valuations that are disconnected from reality (of course, AMC case is no exception).

Both instruments have drawn individual investors who have banded together through social media sites like Reddit’s WallStreetBets and Stocktwits in an effort to limit the profits made by short-sellers who profit when stock prices soar.

According to Henderson, the fundamental issue for arbs is how to protect against a potential severe short squeeze. According to S3 data, the probability that an asset could be caught in a short squeeze has a high “Squeeze Score” for AMC’s common stock.

He also noted that some investors are hedging using a light ratio, shorting less than one AMC for every one APE long, while others are utilizing option techniques on AMC to guard against potentially limitless losses should investors cause a short squeeze.